Tesla Stock 2023 Forecast: Trading Opportunities Exist After Historic Selloff

Tesla Stock 2023 Forecast: Trading Opportunities Exist After Historic Selloff

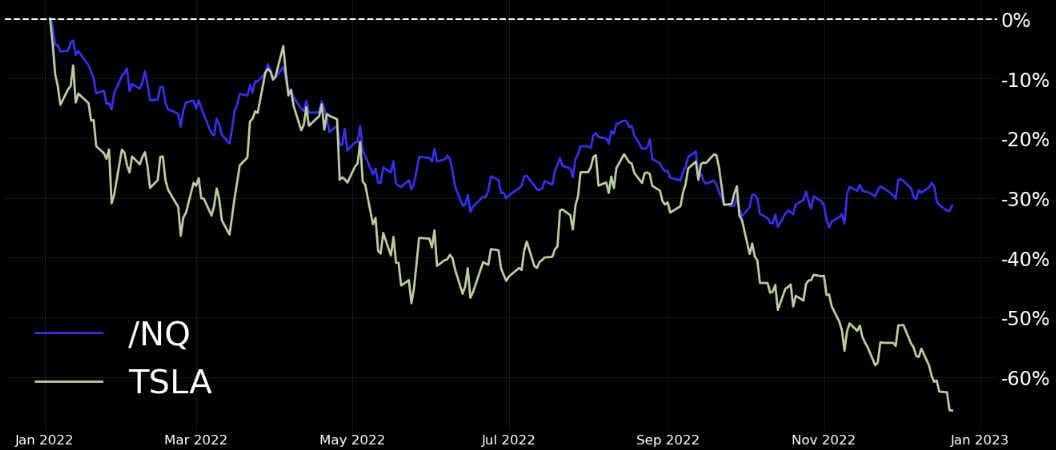

It wasn’t a great year for the stock market in 2022. It was worse for Tesla. A Wall Street darling, the eclectic vehicle stock came under intense selling pressure, providing a long-awaited win to the company’s bears and naysayers. As of late December, Tesla stock was tracking an astonishing year-to-date loss north of 60%. Over the same period, the tech-heavy Nasdaq fell around 30%. This will be the first annual decline since 2016 when Tesla closed the year down by 10.97%.

A bearish repricing in technology stocks isn’t surprising at a time when global interest rates are rising although the pace and depth of losses has shaken even the most ardent Tesla investors. Still, the stock price was trading at more than 200 times its earnings at the start of the year—an unsustainable premium in today’s rate environment many investors would argue, even when considering its favorable margins and sales growth in the sector

The Tesla bears, of which there are plenty, have been waiting for some time to see the stock price collapse like it did, arguing that the fundamentals didn’t support the lofty valuation. If you look at Tesla as an automobile company, those bears were undoubtedly correct. In fact, by market capitalization, Tesla was trading at around ten times the market capitalization of GM and Ford. In December, Tesla traded at a modest $430 billion capitalization, only around 4.3 times that of GM and Ford.

Even so, valuing Tesla as a traditional auto stock misses the mark. As many have found out the hard way, valuing a leader in a developing industry is difficult, and analysts’ price targets for Tesla have turned out to be wildly inaccurate. That may be comforting to the bull camp as various Wall Street analysts have downgraded their price targets over the past several weeks. Colin Rusch, an Oppenheimer analyst, downgraded the stock from outperform to perform in December, citing a severe degradation in sentiment.

Tesla Stock 2023 Outlook: Slowdown in Sight?

However, a return to its previous valuation may be unrealistic. Sales in China have slowed, a concerning factor for what was recently seen as a vital growth avenue. Another argument is that the competition is catching up. Indeed, that is the case, but Tesla got a big head start, and it would take a lot for competitors to close that lead anytime soon. That doesn’t mean that rivals, like Ford, with its electric F-150, can’t take away market share. But Tesla is already producing vehicles with superior margins and losing market share is something investors have expected.

Some argue that Twitter is distracting Elon Musk, which may be true; Mr. Rusch at Oppenheimer believes the negative attention from Twitter could drag on Tesla. If that is hurting sentiment it may abate shortly, as Mr. Musk stated that he is planning on stepping down as Twitter CEO. Given the price decline in 2022, a positive shift in market sentiment whether it be specific to Tesla or the broader market, may arrest the selling and attract those waiting on the sidelines to jump in at what could be seen as a more favorable price.

Tesla Stock 2023: Attractive Trading Opportunity?

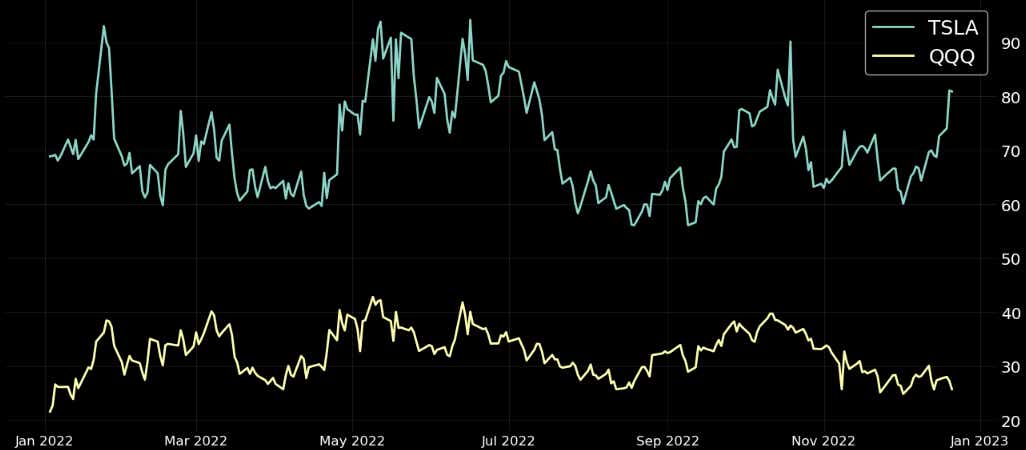

All things considered, even if Tesla’s price continues to slide in 2023, the stock should continue to offer unique trading opportunities. Tesla stock has a relatively high implied volatility (IV),boasting an< IV in December of around 80%. And, of course, the stock offers a highly liquid assortment of options. That presents an opportunity for selling premium for bulls and bears alike.

How to Trade Tesla in 2023

Those with a neutral to bullish bias may want to sell put spreads. And because Tesla options are highly liquid and volatility in the options is skewed—meaning that put options trade with a relatively higher premium—a Jade Lizard strategy may be attractive. For those with a neutral to bearish bias, the high IV makes selling call spreads an enticing option to collect premium.

- Written by Thomas Westwater

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices