Tesla Stock Charges Higher as Bulls Cheer General Motors Charger Deal

Tesla Stock Charges Higher as Bulls Cheer General Motors Charger Deal

Tesla Stock Holding Gains Near 8-Month Highs

Tesla stock rose 2.23%, or $5.44 per share, on Monday as investors remain confident following positive developments that could signal further growth ahead. The move higher follows last week’s 14.22% gain and sets the stock price up for its fifth weekly increase.

For 2023, Tesla is up nearly 100%, a major turnaround from last year and significantly outperforming the broader technology sector’s 33% gain, as measured by the Nasdaq 100 Index (/NQ).

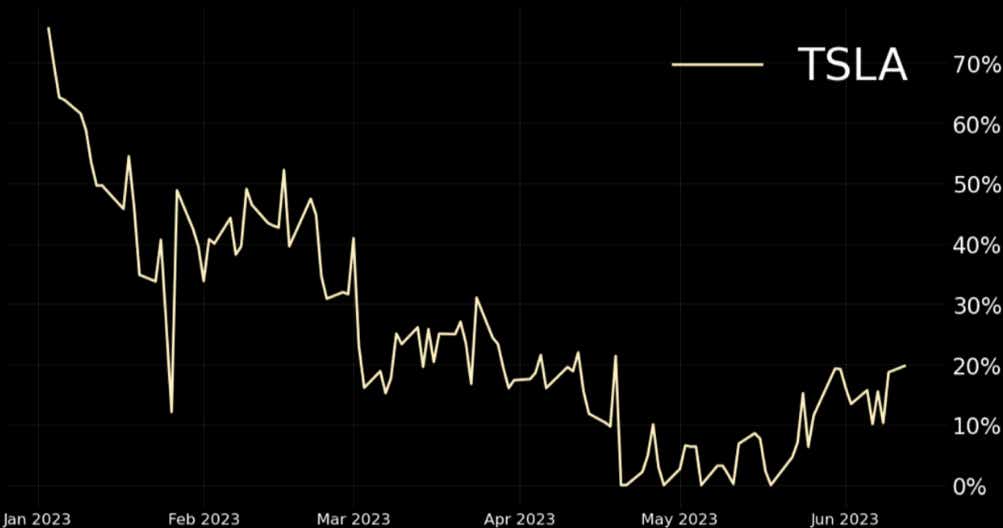

This move has resulted in lower volatility, both across the market and specific to Tesla, which currently boast and IV rank of 19.9. But keep in mind, several events may induce some volatility this week, so traders should maintain a cautious footing.

Tesla IV Rank

What is Driving Tesla Higher?

Over the previous couple of months, Tesla’s charging technology has made significant strides towards becoming the industry standard in North America. Tesla’s proprietary charging design is referred to as the North American Charging Standard (NACS) and has only served Tesla vehicles. All other EVs in the U.S. used the Combined Charging System (CCS).

That is changing, however. In March, Ford announced its electric vehicles will adopt Tesla’s charging standard starting in 2025. In the meantime, Ford’s vehicles will be able to use Tesla chargers with an adapter.

General Motors (GM), last week, announced a similar move, consolidating some of the largest U.S. vehicle producers under one charging standard, marking an industry shift that puts Tesla’s charging infrastructure as the winning horse in this race.

Several EV charging companies also announced on Monday that they would produce connectors for Tesla chargers, including ChargePoint, Tritium and Blink Charging. That brings the total count of companies offering support for the NACS to nearly 20.

Outside of bragging rights, Ford and GM users in the future will add to Tesla’s revenue streams by using the growing network of Supercharger stations, which Tesla owns and operates. The move also brings more uniformity to the electric vehicle industry, which should encourage more people to switch from traditional automobiles to EVs.

Tesla Stock Price Analysis

Prices pierced above several technical barriers over the past few weeks, putting the stock price into a tactically advantageous position to continue its upward path. In late May, prices broke through the 200-day Simple Moving Average (SMA), a level not traded above since 2022.

Since then, the pseudo 50% and 61.8% Fibonacci retracement levels from the August 2022 to January 2023 range have been overtaken. That puts the 78.6% Fib up for a test around the $270 level.

Meanwhile, the Relative Strength Index (RSI) is at 86.74, the highest level since late 2019, indicating strong upward momentum. While an extreme RSI reading is seen as a predictor for a mean reverting move by some, it doesn’t suggest that a short-term retraction is afoot.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices