Global Recession Looms as the US and China Head for Trade Talks

Global Recession Looms as the US and China Head for Trade Talks

By:Ilya Spivak

Both sides appear to desire an offramp, but neither wants to admit defeat

- The US and China want a trade war offramp, but posturing is getting in the way.

- Chinese trade and inflation data due to show the economy remains in sorry shape.

- Global recession looms amid the trade war as global economic activity sputters.

The most critical link in the global supply chain—connecting its two largest economies, China and the US—has been bogged down in what Treasury Secretary Scott Bessent likened to an embargo. He heads to Switzerland this weekend for a meeting with Chinese officials, seeking to begin trade negotiations.

Both countries are trying to put on a brave face in the standoff. President Donald Trump has flatly refused to lower the punishing 145% tariff rate he has imposed on Chinese imports as an opening for talks. A spokesman for China’s foreign ministry said the US should stop “exerting pressure” if it truly wants a negotiated solution.

Posturing aside, China’s economy continues to look anemic

Trump seems clearly intent on lowering tariffs as part of some sort of bargain, saying “right now you can’t get any higher. It’s at 145% so we know it’s coming down.” Meanwhile, China has loudly insisted the US asked for the meeting in Switzerland, and that it is “firmly” opposed to the Trump administration’s actions.

The resulting stalemate seems to amount to the triumph of posturing over practicality. Both sides appear to be searching for an offramp, but neither one looks willing to appear as anything but the victor in the stare-down. Meanwhile, the economies at both ends of the clash are in trouble, and the world is inching closer to recession.

China is expected to report that export growth slowed sharply in April. Economists have penciled in a rise of 1.9% year-on-year after the sharp 12.4% jump in the previous month. Imports are seen falling for the third month straight. Consumer price index (CPI) data is expected to bring ongoing deflation at 0.1% year-on-year.

Global recession approaches as the U.S. and China spar

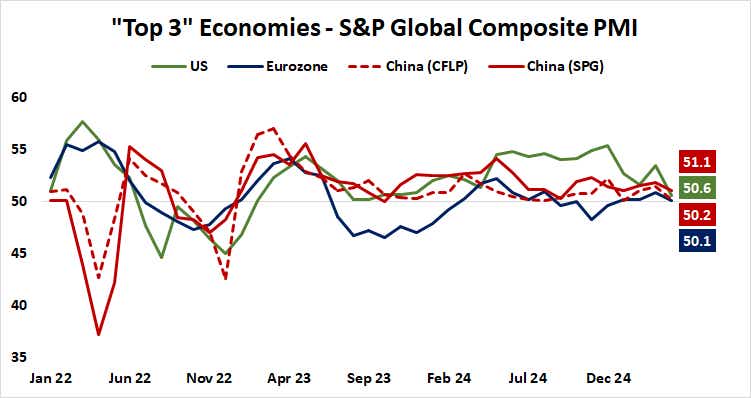

Earlier this week, purchasing managers’ index (PMI) data from S&P Global and Caixin put Chinese economic activity growth at the weakest in three months. Business sentiment fell to the lowest since the survey began in 2012. That lined up with official PMI statistics from the China Federation of Logistics and Purchasing (CFLP).

Meanwhile, dual U.S. PMI data from S&P Global and the Institute of Supply Management (ISM) flashed stagflation warning signs. The two surveys diverged a bit on the details—manufacturing appeared stronger and services weaker in the former compared with the latter—but both agreed growth is now at a near standstill after blistering results last year.

Taken together, this means China’s economy continues to tread water, and that of the U.S. has rapidly converged downward in the same direction. That makes it hardly surprising to see worldwide economic activity growth slow to the weakest in 17 months in April, according to S&P Global and JPMorgan global PMI statistics.

Stock markets have scored runaway gains since the S&P 500 crashed to a 15-month low last month. That has reset them back to levels preceding Trump’s so-called “Liberation Day” unveiling of sweeping tariff hikes. The sell-off of close to 10% preceding it from mid-February highs was about recession fears. Those may be back before long.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.