Dollar to Fall While Stocks Rise as Markets Digest Scary News Flow: Macro Week Ahead

Dollar to Fall While Stocks Rise as Markets Digest Scary News Flow: Macro Week Ahead

By:Ilya Spivak

Stock markets may build on last week’s explosive gains while the U.S. dollar falls as geopolitical and economic news stops getting worse while markets cheer central banks’ pivot away from interest rate hikes

- Markets may lift stocks and the Australian dollar if the RBA holds back a rate hike

- Chinese trade and inflation data need only be “tolerable” to lift financial markets

- For a pair of speeches from Fed Chair Powell, the mission now is to do no harm.

Stock markets roared higher last week as the geopolitical risk premium traders had embedded into markets amid the crisis in the Middle East began to recede. Meanwhile, the Federal Reserve signaled it is probably finished raising interest rates. The bellwether S&P 500 index added 5.76%, marking the largest weekly rise since June 2022.

Israel has stepped up efforts to destroy the Gaza-based Hamas, a terrorist group that launched an Oct. 7 attack that killed 1,400 civilians and took 240 hostages. However, gold has tellingly stalled while crude oil prices have drifted lower, signaling markets don’t expect new combatants to enter the fray.

Treasury bonds rose as the Fed’s messaging pushed yields lower across maturities. The biggest moves showed up in longer-dated maturities, with 30-year paper rising nearly 4%. The U.S. dollar slumped against its major counterparts, shedding 2%. That marks its worst performance in four months.

Here are the key macro waypoints for traders in the week ahead:

Reserve Bank of Australia monetary policy meeting

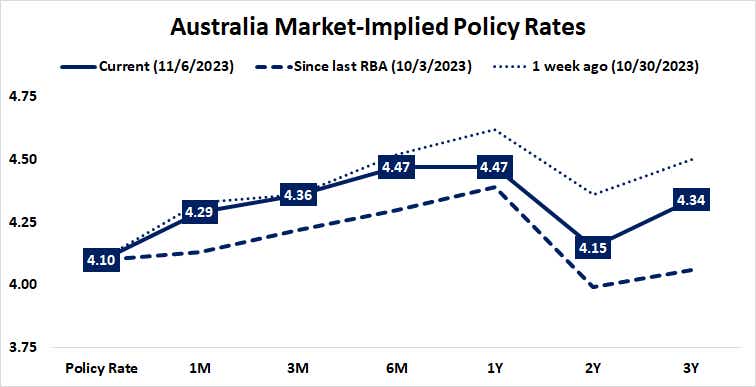

Australia’s central bank is narrowly expected to issue one final interest rate hike to top off the blistering tightening cycle started in mid-2022. Rates increased by a hefty 4% in just 11 months. The probability of parting 25-basis-point (bps) rise is priced in at 58%, giving the outcome narrowly better-than-even odds.

If recently installed Governor Michele Bullock opts to hold fire this time, she and her colleagues are seen delivering the increase no later than the Royal Bank of Australia’s (RBA’s) first meeting of 2024, in early February. The likelihood that the hike will happen at the intervening meeting in December is priced at 76%.

Leading purchasing manager’s index (PMI) data points to rapidly deteriorating economic conditions. The manufacturing and service sectors are shrinking at an accelerating pace and weak demand has made firms unable to pass through rising input costs. If this nudges the RBA to hold fire, traders will be keen to gauge the tone of the policy statement.

Guidance offering the usual tough talk on inflation but signaling an easing cycle is coming into view is likely to be cheered by stock markets. They have recently rewarded similar sentiments from central banks in Europe and the U.S. The Australian dollar is finding a way higher as capital flows search for bargains in battered corners of the markets where a policy lifeline seems closest at hand.

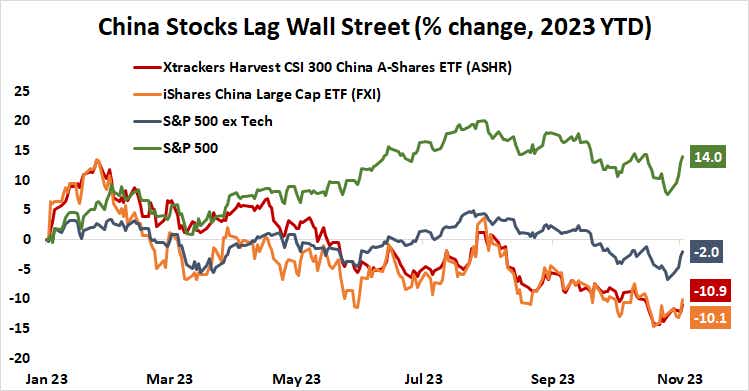

Trading China consumer price index data

A similar story is likely to play out as China’s trade and consumer price index (CPI) data cross the wires. Exports and imports are seen falling yet again, shedding 3.5% and 5% year-on-year respectively in October. The headline inflation measure is expected to register at -0.1% over the same period, pointing to continued demand of erosion.

Nevertheless, analytics from Citigroup suggests Chinese data outcomes now skew toward surprising on the upside relative to expectations. This may indicate markets have already priced in the bulk of the bad news about the country’s slow reopening after COVID-19 lockdowns.

Results need not be “good” in this case, with investors settling for “tolerable” to nibble on bargain-hunting opportunities in Chinese assets. Local markets have vastly underperformed U.S. analogs this year, and numbers suggesting conditions have stopped getting worse may encourage some catch-up gains.

Federal Reserve Chair Powell speaks

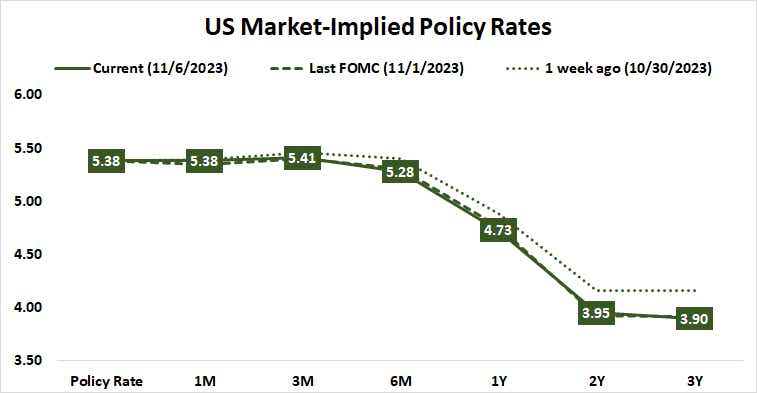

A pair of speeches from Fed Chair Jerome Powell are on the menu this week. Thursday’s appearance at the International Monetary Fund’s (IMF) annual research conference— the latter of the two— is likely to have more market-moving potential. Powell will take part in a panel on today’s global policy challenges and sit for a moderated Q&A.

At this stage in the cycle, Powell need only ensure that his comments do no harm by introducing fresh uncertainty into the U.S. policy outlook. This means that he is likely to echo sentiments on display following last week’s Federal Open Market Committee (FOMC) meeting.

That is, hikes are probably finished but there will be some delay before cuts begin, enabling the economy to absorb previous tightening. The markets read the outcome as implying cuts will come more quickly—now set to begin in June—and there will be more of them (at least 75 bps-worth). More of this “sooner and lower” perspective is likely to help Wall Street and weigh on the U.S. dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices