Are Chinese Stocks Ready to Rebound?

Are Chinese Stocks Ready to Rebound?

By:Ilya Spivak

China’s economy probably slowed in the third quarter. Stocks, currencies and commodities linked to its performance might rebound anyway.

- Chinese stocks have suffered in 2023 as the economy has struggled to find its footing.

- The critical mass of “bad” Chinese economic news may have passed for now.

- China-linked ETFs, currencies and commodities may cheer “tolerable” GDP data.

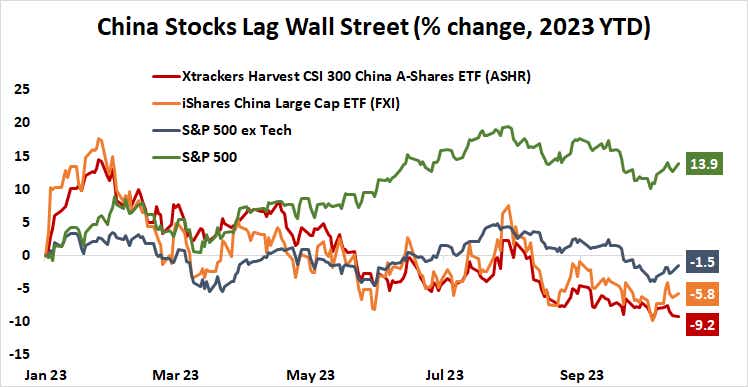

Chinese stock markets are struggling to keep pace with their U.S. counterparts this year.

The closely watched iShares China Large Cap ETF (FXI) tracking the biggest listings on the country’s exchanges is down nearly 6% so far in 2023. The broader-based Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) paints an even bleaker picture, down over 9%.

In contrast, the S&P 500 is up 13.9% over the same period. Even after stripping out the high-flying tech sector, U.S. names are down just 1.5% on average since the start of 2023. While much can be said about the pitfalls of such concentration, U.S. shares have clearly outperformed Chinese alternatives.

China’s economy is in a crisis after COVID-19 lockdowns

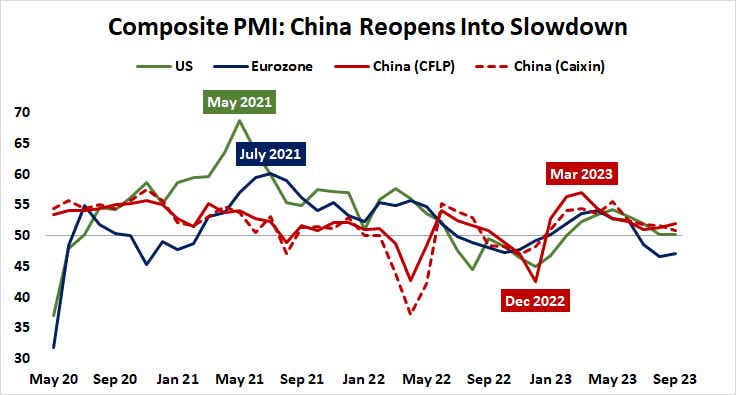

This lackluster showing echoes Beijing’s struggle to revive the world’s second-largest economy after scrapping COVID-19 lockdowns in December 2022. The belated reopening lagged China’s main export markets in the U.S. and Europe by nearly two years. They’d busied themselves diversifying supply chains while the East Asian languished in quarantine.

What’s more, ebbing support from fiscal stimulus and a campaign of rapid interest rate hikes from the Federal Reserve and the European Central Bank (ECB) meant that demand had significantly weakened by the time China reemerged. Spurts of rapid catch-up growth after the worst of the pandemic had already peaked by mid-2021.

Investors geared up for China’s big-splash return to form at the start of 2023 have been let down in spectacular fashion. Domestic demand has fizzled alongside the external sector, triggering turmoil in the mission-critical property market. That has driven capital flight, punishing the Chinese yuan.

Stimulus efforts have proven to be lackluster. A modest round of interest rate cuts and an assortment of measures meant to spur activity—like lowering barriers to property purchases and mandating lower bank reserve requirement ratios to free up capital—have made little difference. President Xi Jinping has played down scope for fiscal aid at scale.

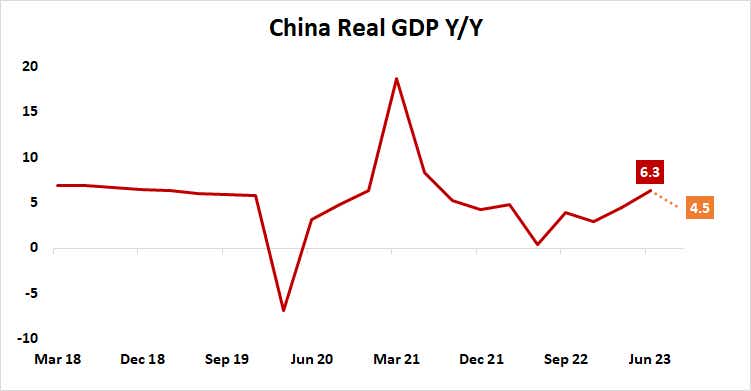

Against this backdrop, data due for release this week is expected to show that Chinese economic growth decelerated in the third quarter. A survey of economists polled by Bloomberg anticipates that gross domestic product (GDP) grew 4.5% year-on-year, down from the 6.3% recorded in the three months through June.

Do markets still fear weak Chinese economic data?

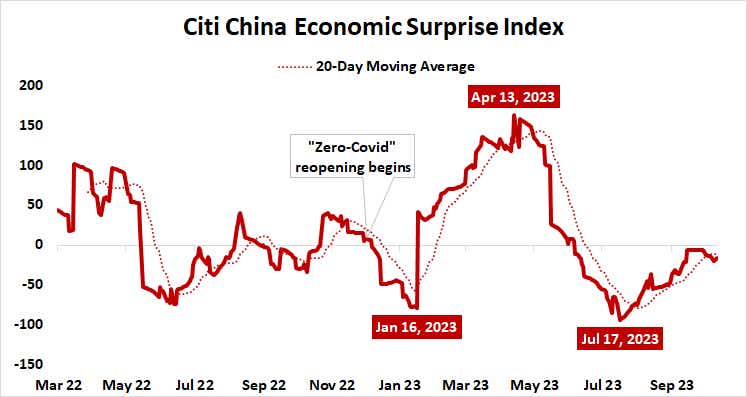

The key question now facing investors is whether another bit of downbeat economic news-flow offers anything that is yet to be priced into asset values after nearly a year of frustration since China’s reopening began.

Analytics from Citigroup suggest that Chinese data outcomes still skew toward surprising on the downside relative to baseline forecasts. However, the margin for disappointment has narrowed as analysts have revised expectations lower. This means that the bar for a “bad” outcome might be asymmetrically higher than a “tolerable” one.

Leading surveys of purchasing managers have foreshadowed a slowdown from the second to the third quarter for some time. Meanwhile, some cautious green shoots have appeared.

Data released alongside GDP is expected to show retail sales growth picked up for a second month in September. Lending statistics published over the weekend showed aggregate financing increased by about 8 billion yuan in the three months to September compared with the prior period, implying a bit of a thaw. The yuan is stabilizing.

On balance, this means that growth figures hewing closely to expectations might translate as supportive for China-sensitive assets, with investors setting their signs on bargain-hunting amid speculation that the critical mass of “bad news” is already behind them.

Trackers of Chinese stocks like FXI and ASHR may rise alongside currencies and commodities sensitive to the country’s economic fortunes, like the Australian dollar and copper. The broader risky asset universe—global equities and other cycle-sensitive assets—may also get something of a lift.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices