Stocks are in Trouble if Stagflation Worries Build: PMI Preview

Stocks are in Trouble if Stagflation Worries Build: PMI Preview

By:Ilya Spivak

Will the markets run for cover as “stagflation” worries multiply?

- UK CPI data adds to mounting evidence of returning inflation worldwide.

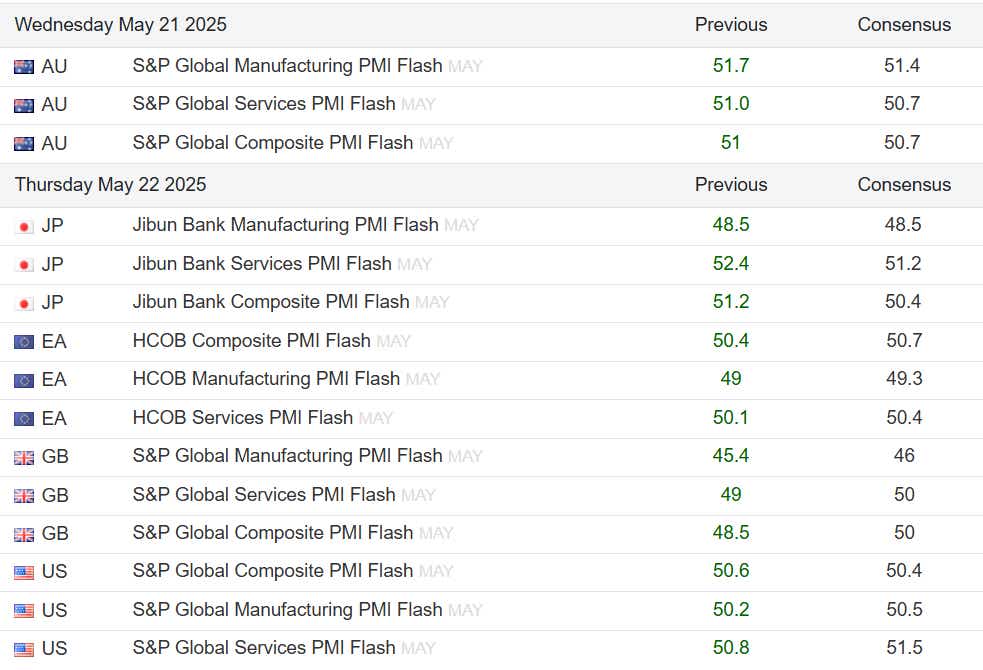

- S&P Global PMI surveys may put global growth at near-standstill again.

- Stock markets are in trouble if “stagflation” speculation is taking hold.

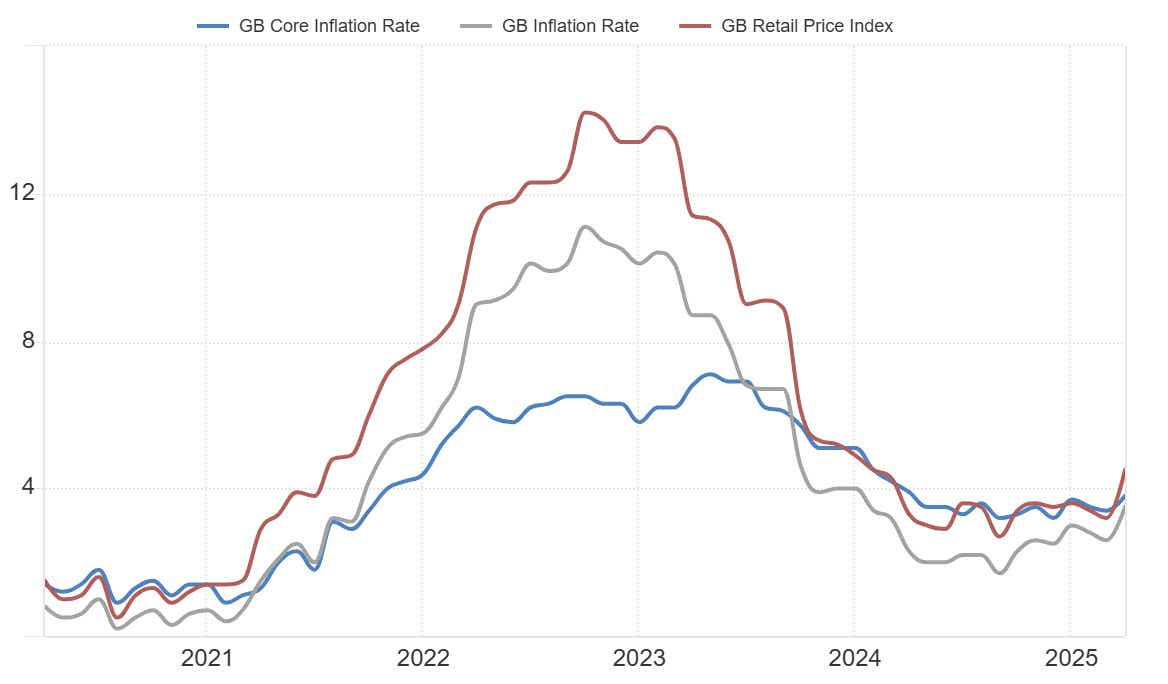

Signs of returning inflation are showing up across major economies. A pickup in the pace of price growth showed up in data out of the Eurozone and Canada early in the week. The UK has now joined this list. April’s consumer price index (CPI) figures produced a headline price rise of 3.5% year-on-year, topping baseline expectations.

April was always going to bring distortions in the UK inflation picture. It marked a sharp rise in the price of utilities like water and energy as well as other regulated services. Ofgem’s energy price cap rose and a new vehicle excise duty on electric vehicles came into force. Nevertheless, the results look striking.

UK CPI data adds to signs that global inflation is rebuilding

Overall price growth has risen to the highest in 15 months. Core inflation excluding volatile inputs like food and energy prices registered at 3.8%, the fastest in a year. The retail price index (RPI) – a measure closely tracked by the Bank of England (BOE) – rose to 4.5%, returning to a level unseen since February 2024.

The markets clearly judged that these high-flying figures are influential enough that they will restrict scope for BOE interest rate cuts, no matter where the price shocks come from. Front-end UK gilt yields rose to the highest level in almost two months, tracking a hawkish shift in the policy path implied in benchmark SONIA interest rate futures.

This makes for a worrying backdrop as an ominous set of economic growth indicators looms ahead. The May update of closely watched purchasing managers index (PMI) data from S&P Global is expected to show that activity growth in two out three engines of worldwide demand – the US and the Eurozone – remains near standstill.

Stocks may struggle if “stagflation” fears grip markets

This seems hardly encouraging after April’s edition of the data suggested that global growth slowed to the weakest in 17 months. Looking through the fog of trade war headlines, the first quarter produced the weakest US consumption growth in almost two years. Last week’s data flow suggested the second quarter is on track for another poor showing.

Taken together with anemic performance in Europe and China stretching back to the middle of last year, this makes for a potent recessionary threat. Coming alongside faster price growth, all this sets the stage for the kind of “stagflation” nightmare that keeps central bankers up at night. Stock markets may find that tough to manage.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.