US CPI Inflation, Retail Sales, Consumer Confidence: Macro Week Ahead

US CPI Inflation, Retail Sales, Consumer Confidence: Macro Week Ahead

By:Ilya Spivak

Stocks may find trouble the markets still want more rate cuts just as the Fed gets a reason for delay

- Stock markets have idled so far in July, but the battered US dollar is recovering

- US CPI data now in focus as markets and the Fed clash on rate cut expectations

- Retail sales and consumer sentiment data may show why markets want easing

Stock markets stalled last week, with the bellwether S&P 500 and the tech-tilted Nasdaq 100 down 0.4% and 0.5% respectively. Prices have idled in a narrow range since surging in thin trade after a seemingly solid US jobs report on July 3. Treasury bond yields edged higher at the long end of the curve and held steady at shorter-term maturities.

Gold and crude oil prices continued to edge higher, though neither made meaningful progress on trade development. The yellow metal has languished in a range for the better part of three weeks, while the benchmark WTI contract continues to digest after an eye-watering plunge of nearly 12% as fears about an escalating US-Iran conflict faded.

The US dollar has continued a quiet recovery, adding 0.6% against the euro and 1.7% against the Japanese yen. The currency suffered historic losses in the first six months of the year. An average of its value against major counterparts fell 9.5% from January through June, marking the worst losses since the back half of 1991.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

US consumer price index (CPI) data

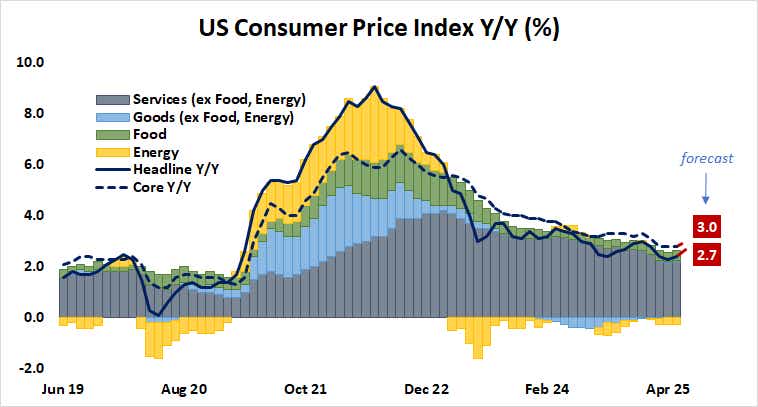

Inflation is expected to have moved higher in the US last month. The headline consumer price index (CPI) is penciled in for a rise of 2.7% year-on-year, while the core measure excluding volatile food and energy prices returns to 3%. Taken together, that would mark the fastest price growth in four months.

An elevated CPI reading would bolster the case for inaction at the Federal Reserve, where Chair Powell and company have resisted market and White House calls for easing. The markets price in 104 basis points (bps) in rate cuts through the end of 2026, while the US central bank forecasts a more modest 75bps.

US retail sales data

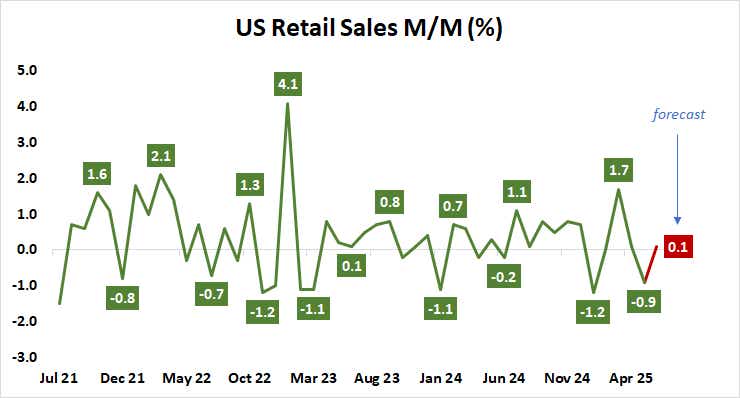

A modest rise of 0.1% in US retail sales is expected when June’s data comes across the wires this week. While that would amount to a modest improvement from the 0.9% decline in May, the absence of a spirited push to front-run incoming tariff hikes slated for August would be glaring.

Consumption is the overwhelmingly dominant driver of US economic growth, accounting for close to 68% of gross domestic product (GDP). Tariff-induced anomalies in imports and inventories aside, first-quarter growth data showed a worrying small contribution on this front, coming in at the weakest in almost two years.

University of Michigan (UofM) consumer confidence survey

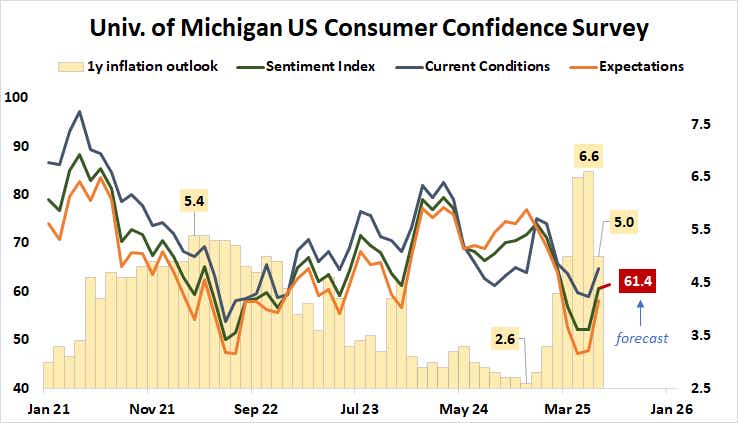

If the rise in retail sales proves to be as soggy as economists anticipate, another uptick in consumer confidence slated to appear in a closely watched survey from the University of Michigan (UofM) this week would tell a very different story than meets the eye. It would seem doubly troubling if calming consumers’ nerves is not translating into demand.

The headline sentiment gauge jumped to a four-month high in June as ebbing tariff-related fears brought consumers’ one-year inflation expectations down from an eye-watering peak of 6.6% in May to 5%. That is still very high compared with November’s cycle low of 2.6%, but nevertheless a move in the right direction.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices