Recession Fears May Return Just as Tariff Uncertainty Heats Up

Recession Fears May Return Just as Tariff Uncertainty Heats Up

By:Ilya Spivak

Stocks and the dollar are in trouble with US trade policy in limbo and recession on the march

- Global markets seesaw as US courts block the Trump tariff agenda.

- US trade policy Uncertainty may now extend longer than expected.

- Incoming US and China PMI data may revive global recession fears.

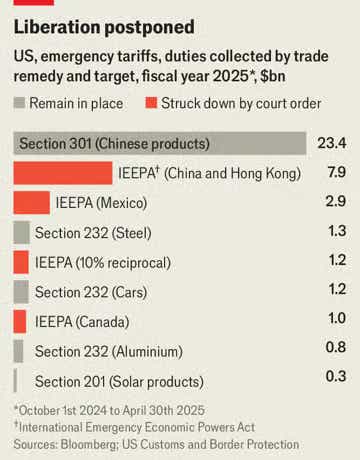

Financial markets seesawed as two US federal courts moved to block the Trump administration’s expansive tariff hikes. The US Court of International Trade struck down so-called “reciprocal” duties as well as those ostensibly aimed at cajoling China, Mexico and Canada to do more on stemming the flow the fentanyl and its precursors into the US.

Those levies were based on a 1977 law called the International Emergency Economic Powers Act (IEEPA). The White House argued that persistent trade deficits as well as the fentanyl abuse crisis amounted to justifiable national emergencies covered by the act, which then gave Mr. Trump the authority to “regulate” imports. The court disagreed.

Financial markets seesaw as federal courts block US tariff plans

A similar ruling striking down the administration’s application of IEEPA came from D.C. District Court Judge Rudolph Contreras. He called the tariffs “unlawful” and ordered a preliminary injunction on collecting the duties, but stayed the order for 14 days “so the parties may seek review in the Court of Appeals.”

Futures tracking major US stock indexes surged as the news hit the wires, with contracts on the bellwether S&P 500 as well as the tech-tilted Nasdaq 100 jumping to the highest levels in two months. The US dollar jumped upward against major currencies, yields pushed higher as bonds declined across maturities, and gold prices slumped.

That first reaction proved to be short-lived, however. Traders’ exuberance burned bright for about four hours in Asia-Pacific trade, then hit a wall. A rapid swing in the opposite direction kicked off as European bourses came online and played through most of the US cash equities session.

Can the Trump administration revive tariffs by other means?

Wall Street has erased all of its gains. On average, the major US indexes are limped into the close with modest losses, while bonds finished the session on the upside. The dollar lost about 0.5% against a basket of its top counterparts and gold prices rose nearly 1%.

The turnaround probably reflects the added uncertainty that the rulings have introduced into US trade policy. The administration promptly appealed the ruling and is likely to cite other laws, like the 1974 Trade Act, to try reinstating the tariffs. That might create a five-month window in which today’s IEEPA block might be overturned.

Tariffs based on this law or the Trade Expansion Act of 1962 remain in place. Mr. Trump and company may try to reframe their full protectionist agenda in these terms, but the justification process involved is cumbersome and time-consuming, especially if all major US trading relationships have to be managed at once.

US and China PMI data may fuel global recession fears

Against this backdrop, purchasing managers index (PMI) data from China and the US are expected to show that both countries’ manufacturing sectors contracted in May. This implies that outsized restocking to front-running the tariffs – a key tailwind for growth so far this year – has run out of runway.

Meanwhile, revised first-quarter US gross domestic product data confirmed the weakest consumption in almost two years despite businesses shielding consumers from tariff costs. Updated consumer confidence data from the University of Michigan (UofM) is expected to confirm the most downbeat settings since post-COVID lows in mid-2022.

Taken together with prolonged uncertainty about trade policy and a Federal Reserve reluctant to cut interest rates, all this may boil down to recession speculation. If so, stocks and the US dollar may succumb to selling pressure while Treasury bonds and gold prices extend upward.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices