Stocks Fell After US-China Trade Truce, Rosy Inflation Data. Why?

Stocks Fell After US-China Trade Truce, Rosy Inflation Data. Why?

By:Ilya Spivak

The mood on Wall Street soured despite a US-China trade truce and rosy US CPI data. What’s wrong?

- Stocks fell despite cooler-than-expected US inflation and a US-China trade truce.

- Traders may be waiting for PPI figures to see if the rosy CPI results are a mirage.

- Renewed détente in the US-China trade war may mean little for global growth.

Wall Street seemed unimpressed as negotiators from the US and China reached a “handshake agreement” to revive a trade war truce after a series of meetings in London. The bellwether S&P 500 stock index finished the cash trading session down 0.26% after rising to a four-month high intraday.

A similar story is on display in the tech-tilted Nasdaq 100 and the small-cap Russell 2000. The former rose to the highest level since February 21 while the latter reached prices unseen since March 3 before both indexes reversed lower, erasing gains and ending the day down 0.34% and 0.42% respectively.

Stock markets struggle to embrace “normal” US inflation figures

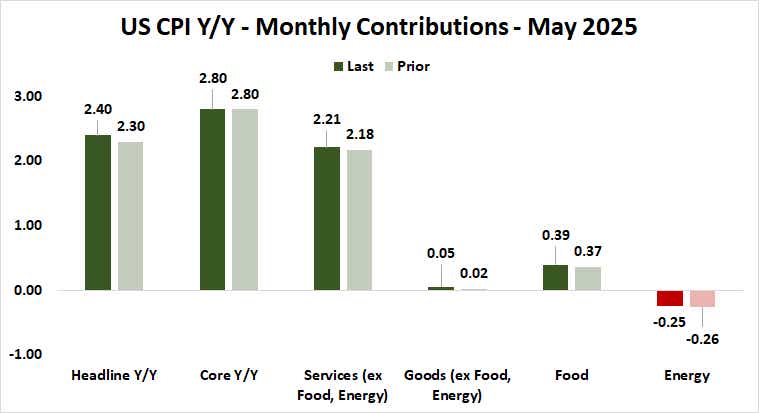

Wall Street cheered cooler-than-expected US inflation data, but a brief uplift to prices as the numbers crossed the wires fizzled within a mere hour of trading. The Bureau of Labor Statistics (BLS) said headline price growth accelerated to 2.4% year-on-year in May, up from 2.3% in April but a touch lower than the 2.5% expected by economists.

Core inflation excluding volatile food and energy prices held steady at 2.8%, undershooting expectations for a rise to 2.9%. Perhaps most critically, worries about a tariff-driven rise in goods inflation did not materialize last month. Services dominated price growth once again, accounting for 2.21 percentage points (ppt) of the overall rise.

Maybe traders were unwilling to give “normal”-looking CPI data the benefit of the doubt this time after similar figures turned out to be somewhat misleading in April, when producer price index (PPI) figures revealed that consumers were shielded from tariff-linked inflation as businesses took a hit on margins. May’s PPI update is due tomorrow.

What does the US-China trade truce mean for the global economy?

The US and China walked back the latest flare up in their trade war, returning to the uneasy détente carved out last month in Geneva that brought bilateral tariff rates down from embargo-level highs. China agreed to remove export restrictions on rare earth minerals while the US pledged access to its universities for Chinese students.

.png?format=pjpg&auto=webp&quality=50&width=1920&disable=upscale)

As with the US CPI result, the markets’ reaction was ultimately circumspect. This is perhaps because the deal seems to offer little hope for a breakthrough for China’s economy, which has been stuck in a deflationary rut for eight consecutive quarters. Data published just this week highlighted as much yet again.

Export growth slowed to 4.8% year-on-year in May after bursts of strength in March and April as efforts to front-run US tariffs fueled a restocking rush. Imports fell 3.4%, marking the worst result in three months. That pointed to weak domestic demand as well as diminished appetite for inputs feeding into export-driven growth.

Meanwhile, CPI fell 0.1% year-on-year for a third consecutive month, and the fourth one in negative territory. PPI fell 3.3%, producing the biggest drop in wholesale inflation since July 2023. Incoming retail sales and industrial production figures are expected to produce the weakest results in five and three months, respectively.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.