US PCE: Will this US Inflation Data Convince the Fed to Cut Rates

US PCE: Will this US Inflation Data Convince the Fed to Cut Rates

By:Ilya Spivak

Can PCE inflation data convince the Fed to hear the markets’ calls for rate cuts?

- Markets pause for a breather as geopolitical fears ebb amid Israel-Iran ceasefire.

- Fed’s Powell in “broken record” mode on the second day of testimony in Congress.

- US PCE inflation data next in focus as markets clash with the Fed on rate cut bets.

Stock markets hit the pause button on a rally triggered after the US forced a ceasefire on Israel and Iran that both sides seem to have begrudgingly accepted, at least for now. The bellwether S&P 500 stock index as well as the tech-tilted Nasdaq 100 are angling to finish the day little-changed. The small-cap Russell 2000 is down about 1%.

Cooling geopolitical fears have animated markets since the beginning of the week after an initial shock over the weekend when the US opted to strike Iran’s nuclear sites directly. Washington and Tehran then made a show of mutual de-escalation, calming the waters and mending risk appetite. News of the ceasefire gave sentiment another fillip.

Markets call for more rate cuts as Fed Chair Powell continues to resist

Federal Reserve Chair Jerome Powell stuck to a familiar script on the second day of semi-annual testimony before US lawmakers. Answering questions in the Senate after an appearance in the House of Representatives earlier this week, he continued to make the case for waiting to see how tariffs will impact inflation before resuming interest rate cuts.

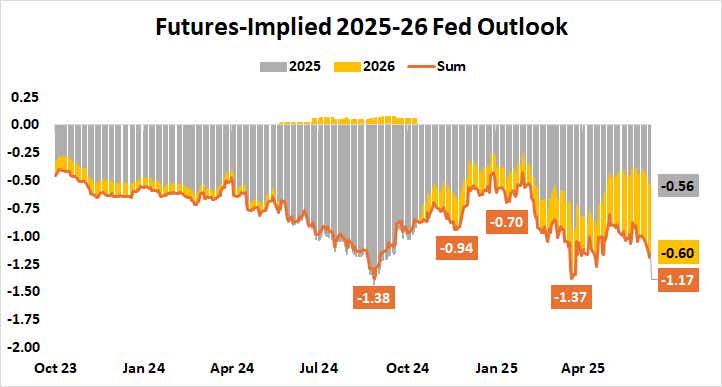

Meanwhile, the disparity between the markets’ expectations for the path of monetary policy and that of Fed officials continues to fester. Policymakers reduced scope for stimulus by one standard-sized 25-basis-point (bps) rate cut through year-end 2026 when they updated their economic forecasts last week.

The markets have moved in the opposite direction. Benchmark Fed Funds futures now price in 117bps in cuts by the end of next year. The biggest disparity appears in 2026, where traders envision 60bps of easing compared with just 25bps penciled in by the US central bank’s policy-steering Federal Open Market Committee (FOMC).

Will PCE inflation data convince the FOMC to stop dithering?

Against this backdrop, the spotlight now turns to the Fed’s favored personal consumption expenditure (PCE) measure of US inflation. The Bureau of Economic Analysis (BEA) is expected to report that headline price growth quickened to 2.3% year-on-year in May, reversing April’s down swing to 2.1% to match the March result.

.png?format=pjpg&auto=webp&quality=50&width=753&disable=upscale)

The core PCE reading excluding volatile food and energy prices – the focus for Fed officials since they have little agency over global commodity costs while most sticky inflation is still locked in the service sector – is seen rising to 2.6%. Encouragingly, that would still be the second-lowest reading since March 2021, after April’s 2.5%.

US economic data outcomes have increasingly soured relative to consensus forecasts over the past month, according to analytics from Citigroup. The US dollar may weaken as Treasury bonds rise if this foreshadows a soggy PCE result that favors the markets’ thinking versus that of the Fed. How stocks fare will depend on whether they decide to notice.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices