Filter

Contents

Iron Butterfly Option Strategy Explained

Contents

What is an iron butterfly option strategy?

An iron butterfly is an advanced options strategy that involves a combination of four different options contracts. Essentially, an iron butterfly combines two spread strategies—a bull put spread and a bear call spread.

An iron butterfly is a limited risk, limited reward strategy and is designed to have a high probability of earning a small limited profit when the underlying asset is believed to have low volatility.

Iron butterflies are typically utilized by investors and traders that expect little to no movement in the underlying. Iron butterflies are constructed using four options contracts—two at the same strike price and two at different strike prices.

Investors and traders might employ the iron butterfly when they expect the underlying asset to trade in a narrow range over the life of the options. This strategy aims to profit from the decay of option premium, which tends to accelerate as expiration approaches.

Overview

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

PROFIT/LOSS CHART

SETUP

Iron butterfly spread options strategy: how it works

The Iron Butterfly strategy is best suited for stocks or other assets that you believe will have little price movement over the life of the options in the spread.

Essentially, an iron butterfly combines two spread strategies—a bull put spread and a bear call spread.

An iron butterfly is a limited risk, limited reward strategy and is designed to have a high probability of earning a small limited profit when the underlying asset is believed to have low volatility.

Investors and traders can follow these general guidelines when constructing and deploying an iron butterfly:

Identify the Underlying Asset

Choose a stock or index that you believe will exhibit low volatility. This means that you expect the asset to stay within a relatively tight price range.

Select the Expiration Date

Depending on your expectations for how long the low volatility will last, you'll select an appropriate expiration date. Shorter-term options (like weekly or monthly) might be selected if you believe prices will remain stable during that window of time.

Determine the at-the-money (ATM) Strike

Look at the current price of the underlying asset. This will be your reference point, and the strike price closest to this will be considered ATM.

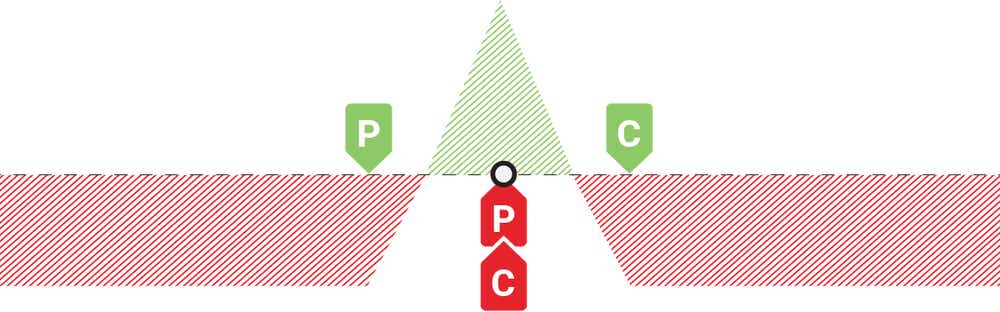

Construct the Iron Butterfly

Sell an ATM Call

Sell an ATM Put

Buy an OTM Call

Buy an OTM Put

Monitor and Adjust if Necessary

If the stock starts moving significantly in one direction, it might breach one of your OTM strikes. In such a case, you may want to adjust your position or exit entirely to limit potential losses.

Close or Let Expire

If the stock is near the ATM strike price at expiration, the options will expire worthless, and you'll realize the maximum profit. If it's closer to one of the OTM strikes, you'll need to manage the position to prevent maximum loss. This might involve buying back the sold options or allowing the bought options to exercise.

The maximum profit from an iron butterfly is the net premium received from selling the ATM options minus the cost of buying the OTM options.

The maximum loss is the difference between the ATM strike and either the call or put OTM strike, minus the net premium received. It's the same whether the stock goes up or down since the distance to the OTM strikes is symmetrical.

How to use the iron butterfly options spread

Iron butterflies are typically utilized by investors and traders that expect little to no movement in the underlying. Iron butterflies are constructed using four options contracts—two at the same strike price and two at different strike prices.

Investors and traders might employ the iron butterfly when they expect the underlying asset to trade in a narrow range over the life of the options. This strategy aims to profit from the decay of option premium, which tends to accelerate as expiration approaches.

tastylive Approach

An iron fly is a defined-risk, at-the-money straddle. Due to the long call and put options, the iron fly requires much less buying power than a straddle. At tastylive, we generally use this strategy when we have a neutral assumption in a high implied volatility (IV) stock. Short iron fly profits are realized when volatility contracts and we are able to purchase the spread to close for less than the initial credit received.

Iron butterfly strategy example

Imagine you're looking at a stock called XYZ, which is currently trading at $100. You believe that over the next month, XYZ will exhibit low volatility, remaining close to $100. To capitalize on this, you decide to deploy an iron butterfly strategy using options that expire in one month.

Constructing the Iron Butterfly

Sell an ATM Call: You sell a call option with a $100 strike price, expiring in one month, for a premium of $5.

Sell an ATM Put: You sell a put option with the same $100 strike price, expiring in one month, for a premium of $5.

Buy an OTM Call: You buy a call option with a $110 strike price (i.e., $10 above the current price), expiring in one month, for a premium of $2.

Buy an OTM Put: You buy a put option with a $90 strike price (i.e., $10 below the current price), expiring in one month, for a premium of $2.

Net Premium Received: ($5 + $5) - ($2 + $2) = $6.

Potential Outcomes

Scenario #1: Stock closes at $100 (ATM)

The ATM call and put you sold both expire worthless since the stock is right at the strike price.

The OTM call and put you bought also expire worthless because the stock hasn't reached either the $110 or $90 strike prices. Your total profit is the net premium received, which is $6.

Scenario #2: Stock closes at $105

The $100 call option you sold will be $5 in the money, costing you $5. The $100 put option you sold expires worthless since the stock is above the strike price. The $110 call option you bought expires worthless, as the stock is below this strike price. The $90 put option you bought also expires worthless. Your total profit: $6 (net premium) - $5 (from the call exercised against you) = $1.

Scenario #3: Stock closes at $115

The $100 call option you sold will be $15 in the money, costing you $15. The $100 put option you sold expires worthless. The $110 call option you bought will be $5 in the money, earning you $5. The $90 put option you bought expires worthless. Your total profit/loss: $6 (net premium) + $5 (from the call you exercised) - $15 (from the call exercised against you) = -$4 (i.e., a loss of $4).

In this example, the best scenario is the stock remaining right at $100. If it moves away from $100 but remains within a $10 range in either direction, you still retain some profit. If it moves beyond that $10 range, your protection from the OTM options comes into play, capping your potential losses.

Remember that in real-world scenarios, factors like broker commissions, bid-ask spreads, and other transaction costs can impact your results. It's also essential to monitor and adjust your position if necessary.

How to calculate max profit and breakevens

The information below highlights how to calculate the maximum profit and breakeven points for an iron butterfly spread.

Maximum Profit

The maximum profit for an iron butterfly is the net premium received when initiating the trade. This happens when the stock price is right at the at-the-money (ATM) strike (where you sold both the call and put) at expiration.

Maximum Profit Formula

Maximum Profit = Net Premium Received from Selling Options − Net Premium Paid for Buying Options

Breakeven Points

There are two breakeven points for an iron butterfly, one on the upside (call side) and one on the downside (put side).

Upside Breakeven Formula

Upside Breakeven = ATM Strike of the Sold Call + Net Premium Received

Downside Breakeven Formula

Downside Breakeven = ATM Strike of the Sold Put − Net Premium Received

MAX PROFIT

Credit Received

BREAKEVEN(S)

Upside:

Short Call Strike + Credit Received

Downside:

Short Put Strike - Credit Received

Should you let an iron butterfly expire?

Whether or not you should let an Iron Butterfly expire depends on the current position of the underlying asset relative to the strike prices of the options involved, as well as your outlook for the remaining time until expiration.

The considerations highlighted below should help guide your decision.

Underlying is Close to the ATM Strike: If the underlying asset is trading very close to the at-the-money strike price of your sold options as expiration approaches, you are in a position to realize maximum profit. If you believe it will stay around this price until the close of trading on expiration day, you might consider letting the position expire. However, keep in mind that if the underlying makes a sudden move, you could end up with an unwanted position or not realize your maximum potential profit.

Underlying is Moving Away from the ATM Strike: If the underlying is moving towards one of the wings (towards your protective OTM options), you risk facing maximum loss. In this scenario, it might be wise to close the position early and manage the loss.

Early Profit Realization: If you've achieved a significant portion of the maximum potential profit before expiration and want to lock in gains, you might decide to close the position early. This move reduces the risk of the market turning against you in the remaining time.

Exercising/Assignment Risk: If any of the options in your iron butterfly are in-the-money as expiration nears, there's a risk of assignment. This could lead to an unwanted stock position. For example, if the put side is in-the-money, you could be assigned and end up buying the stock. Conversely, if the call side is in-the-money, you could be assigned and end up selling the stock. If you don't want this to happen, it's essential to close out those options before expiration.

Transaction Costs: Letting an iron butterfly expire might save you from incurring additional transaction costs associated with closing out the position. However, this should be balanced against the potential benefits of managing the position actively.

Uncertain Outlook: If you're uncertain about the direction of the underlying or expect increased volatility, it might be a good idea to adjust or close the position rather than letting it expire.

Iron butterfly vs iron condor: what are the differences?

A simple way to describe the difference between an iron butterfly and an iron condor is as follows:

Iron Butterfly: You believe a stock will stay very close to a specific price. You sell options right at that price (at-the-money) and buy options further away (out-of-the-money) for protection. This gives you a higher potential profit but a narrower range for that profit.

Iron Condor: You believe a stock will stay within a broader price range, but you're not sure exactly where. You sell options away from the current price (out-of-the-money) and buy even further out options for protection. This gives you a lower potential profit than the iron butterfly, but you have a wider range where you can achieve that profit.

In essence, the iron butterfly has a tighter range with higher potential profit, while the iron condor offers a wider range with smaller profit potential.

Learn more about the Iron Condor option strategy.

Iron butterfly options strategy summed up

- An iron butterfly is an advanced options strategy that involves a combination of four different options contracts. Essentially, an iron butterfly combines two spread strategies—a bull put spread and a bear call spread

- An iron butterfly is a limited risk, limited reward strategy and is designed to have a high probability of earning a small limited profit when the underlying asset is believed to have low volatility

- Iron butterflies are typically utilized by investors and traders that expect little to no movement in the underlying. Iron butterflies are constructed using four options contracts—two at the same strike price and two at different strike prices

- Investors and traders might employ the iron butterfly when they expect the underlying asset to trade in a narrow range over the life of the options. This strategy aims to profit from the decay of option premium, which tends to accelerate as expiration approaches

FAQ

What is a long call butterfly spread option strategy?

An iron butterfly is an advanced options strategy that involves a combination of four different options contracts. Essentially, an iron butterfly combines two spread strategies—a bull put spread and a bear call spread.

An iron butterfly is a limited risk, limited reward strategy and is designed to have a high probability of earning a small limited profit when the underlying asset is believed to have low volatility.

What is the risk of the iron butterfly spread?

The risk of the iron butterfly spread is the potential maximum loss you can incur if the stock price moves significantly either above or below your established range by the expiration date.

It's crucial to keep in mind that with the iron butterfly, the maximum loss is capped because you've purchased those OTM options as protection. If the stock price moves dramatically, these long options will start to offset the losses from the short options, ensuring that the loss doesn't exceed the calculated maximum.

Here's how to calculate the maximum potential loss for an Iron Butterfly:

Maximum Loss = (Difference between one of the sold and bought strike prices) - Net Premium Received

Is the iron butterfly a good strategy?

The iron butterfly can be a good strategy under certain market conditions and for specific investment goals, but like all investment strategies, it has both advantages and drawbacks. Whether it's "good" or not depends on an individual's outlook on the underlying asset, risk tolerance, and market expectations.

The iron butterfly strategy is best suited for stocks or other assets that you believe will have little price movement over the life of the options in the spread.

The ideal outcome for an iron butterfly strategy is for the underlying asset (be it a stock, index, or other security) to close at the strike price of the options you sold (the at-the-money options) at the time of expiration.

Is the iron butterfly better than the iron condor?

Whether the iron butterfly is "better" than the oron condor depends on your market outlook, risk tolerance, and specific objectives. Both strategies are designed to profit from limited price movement in the underlying asset, but they have distinct characteristics and are best suited for different scenarios.

Iron Butterfly: You believe a stock will stay very close to a specific price. You sell options right at that price (at-the-money) and buy options further away (out-of-the-money) for protection. This gives you a higher potential profit but a narrower range for that profit.

Iron Condor: You believe a stock will stay within a broader price range, but you're not sure exactly where. You sell options away from the current price (out-of-the-money) and buy even further out options for protection. This gives you a lower potential profit than the iron butterfly, but you have a wider range where you can achieve that profit.

In essence, the iron butterfly has a tighter range with higher potential profit, while the iron condor offers a wider range with smaller profit potential.

When should I use the iron butterfly strategy?

The iron butterfly strategy is best suited for stocks or other assets that you believe will have little price movement over the life of the options in the spread.

The ideal outcome for an iron butterfly strategy is for the underlying asset (be it a stock, index, or other security) to close at the strike price of the options you sold (the at-the-money options) at the time of expiration.

Episodes on Iron Butterfly

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices